Pay 1099 Workers Easily Without a Subscription

Pay, track, and onboard your contractors easily and automatically.

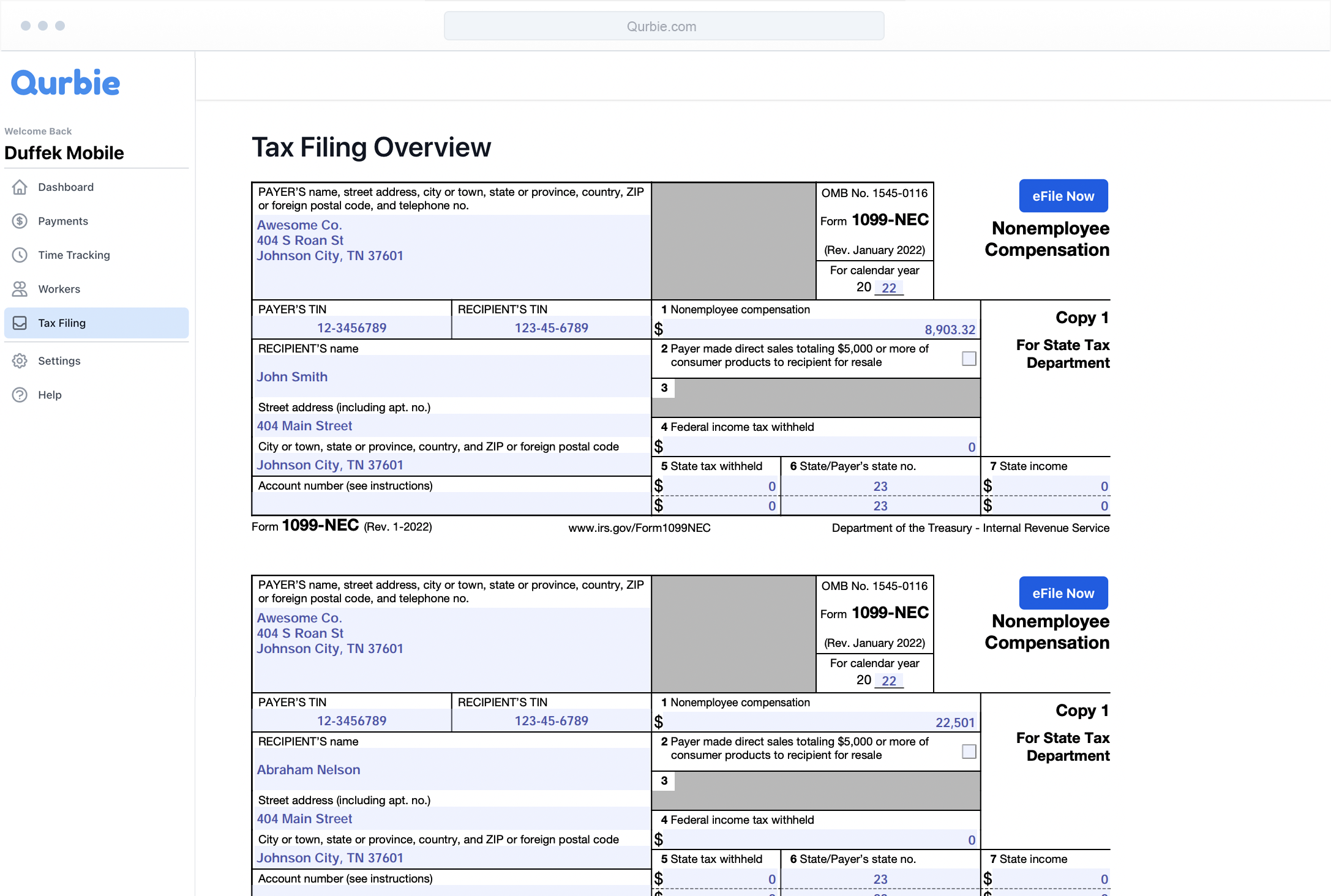

Qurbie even helps file your 1099 tax forms at the end of the year.

Agencies and Startups of All Sizes Trust Qurbie

Everything You Need to Manage Contractors

Automate almost every step of the management process while staying in control of every event.

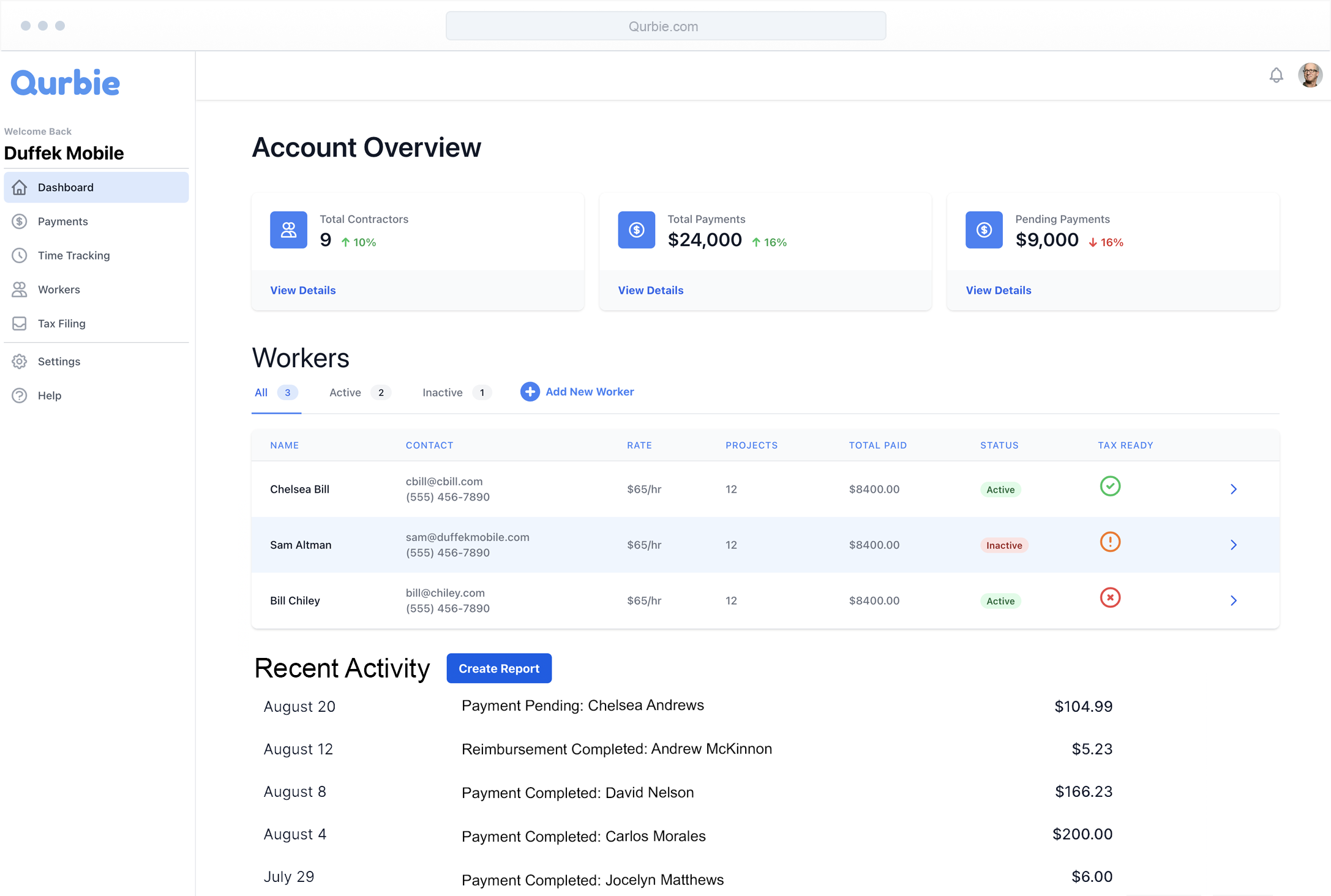

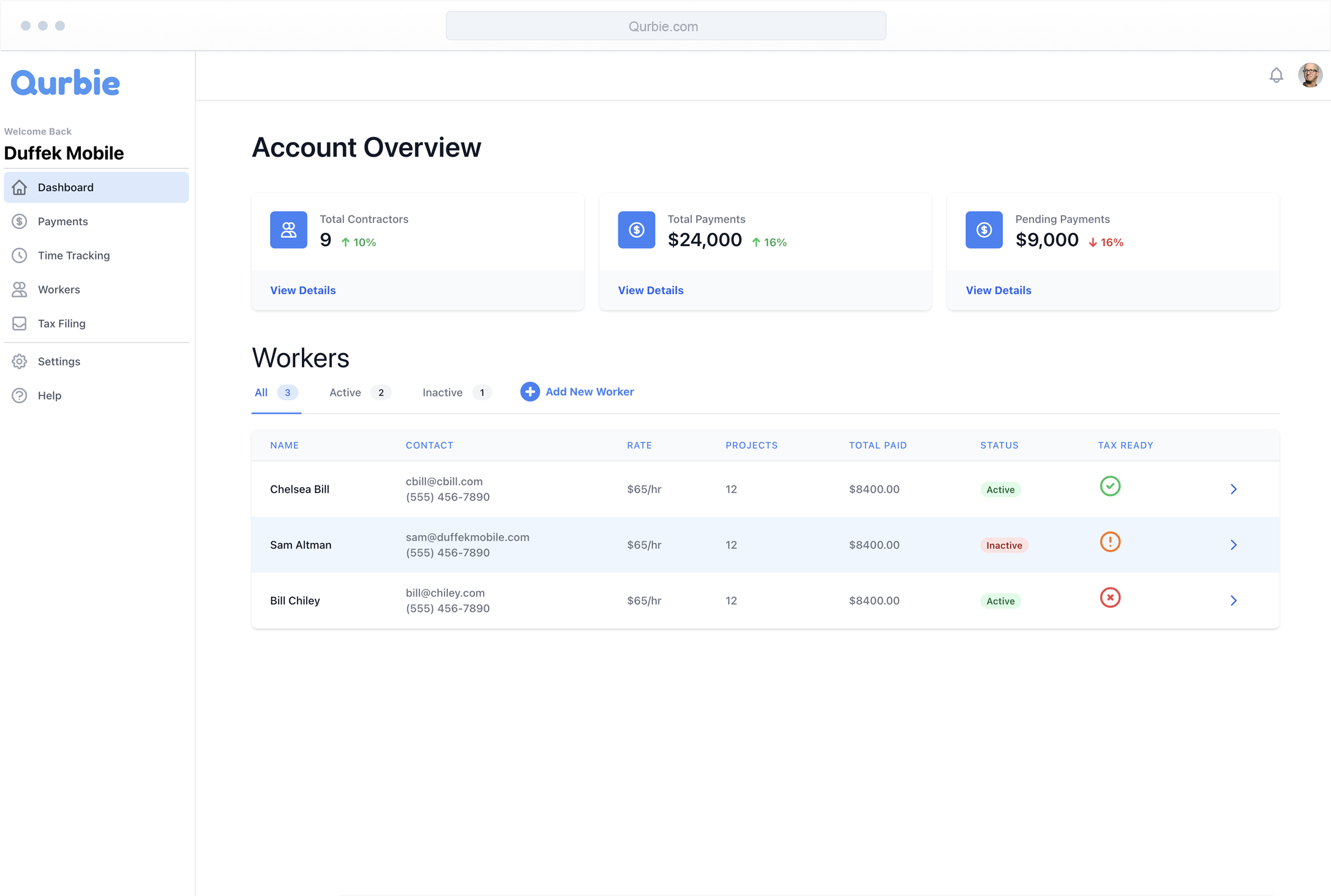

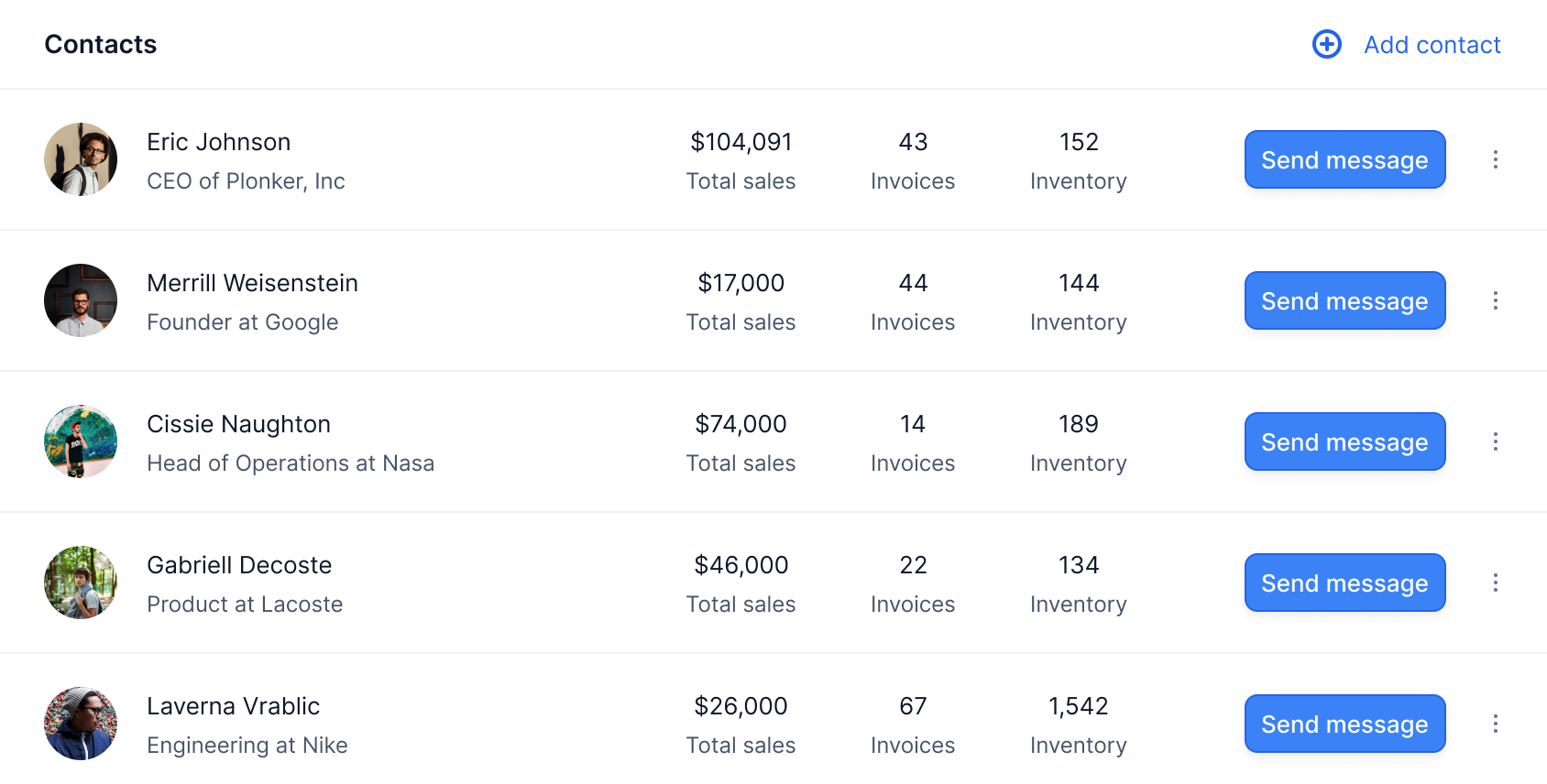

Contractors enter their hours and request payment. After you approve their work they get paid with direct deposit in days.

Get Started in 3 Easy Steps

Qurbie is incredibly easy to setup. Then it manages your contractors every step of the way. Plus, you always know what is happening.

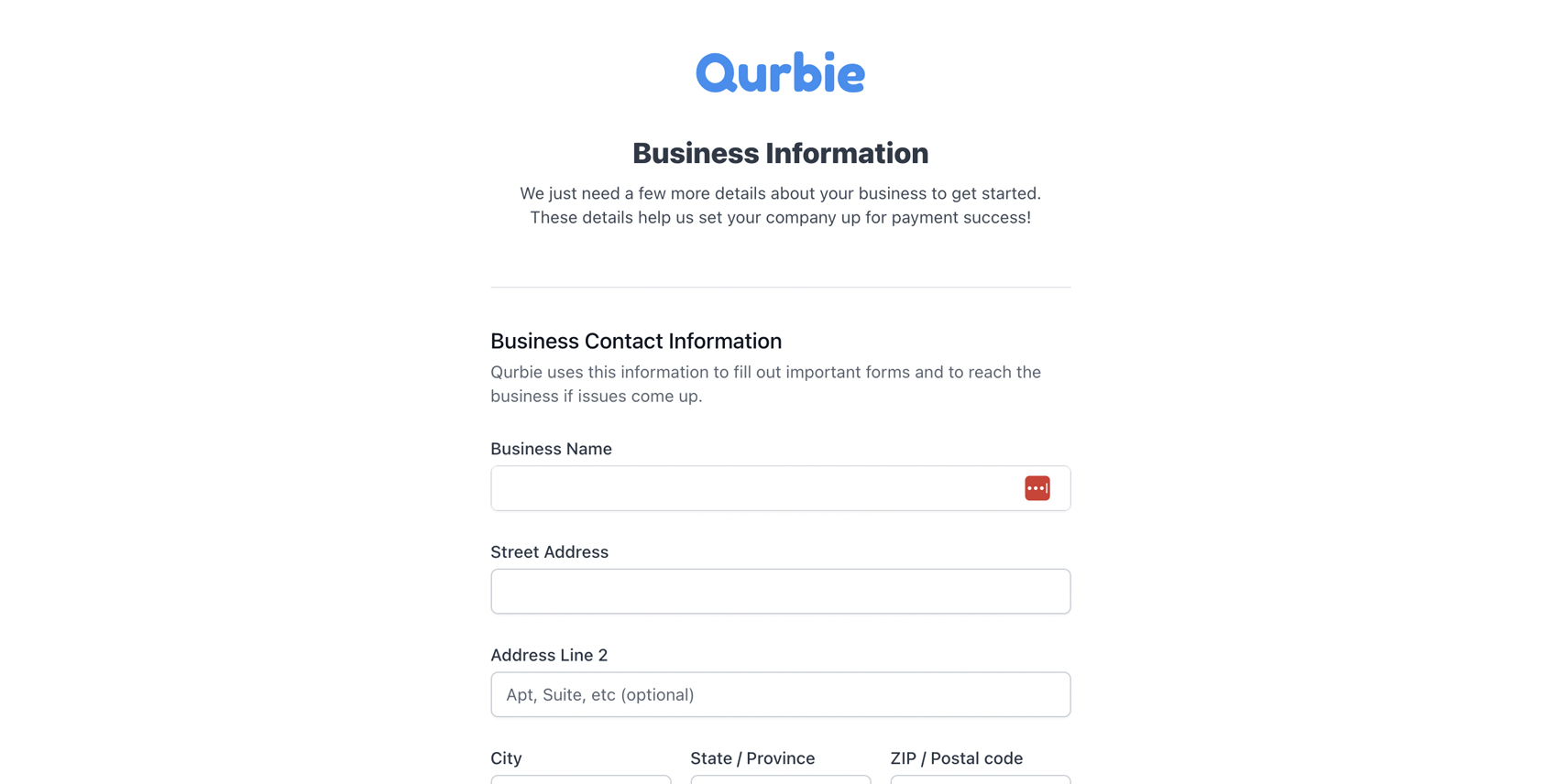

Setup Your Account

To get started, Qurbie simply needs basic information about your buisiness.

Create an account, verify your identity, and setup your company profile in just a few moments.

Invite Your Team

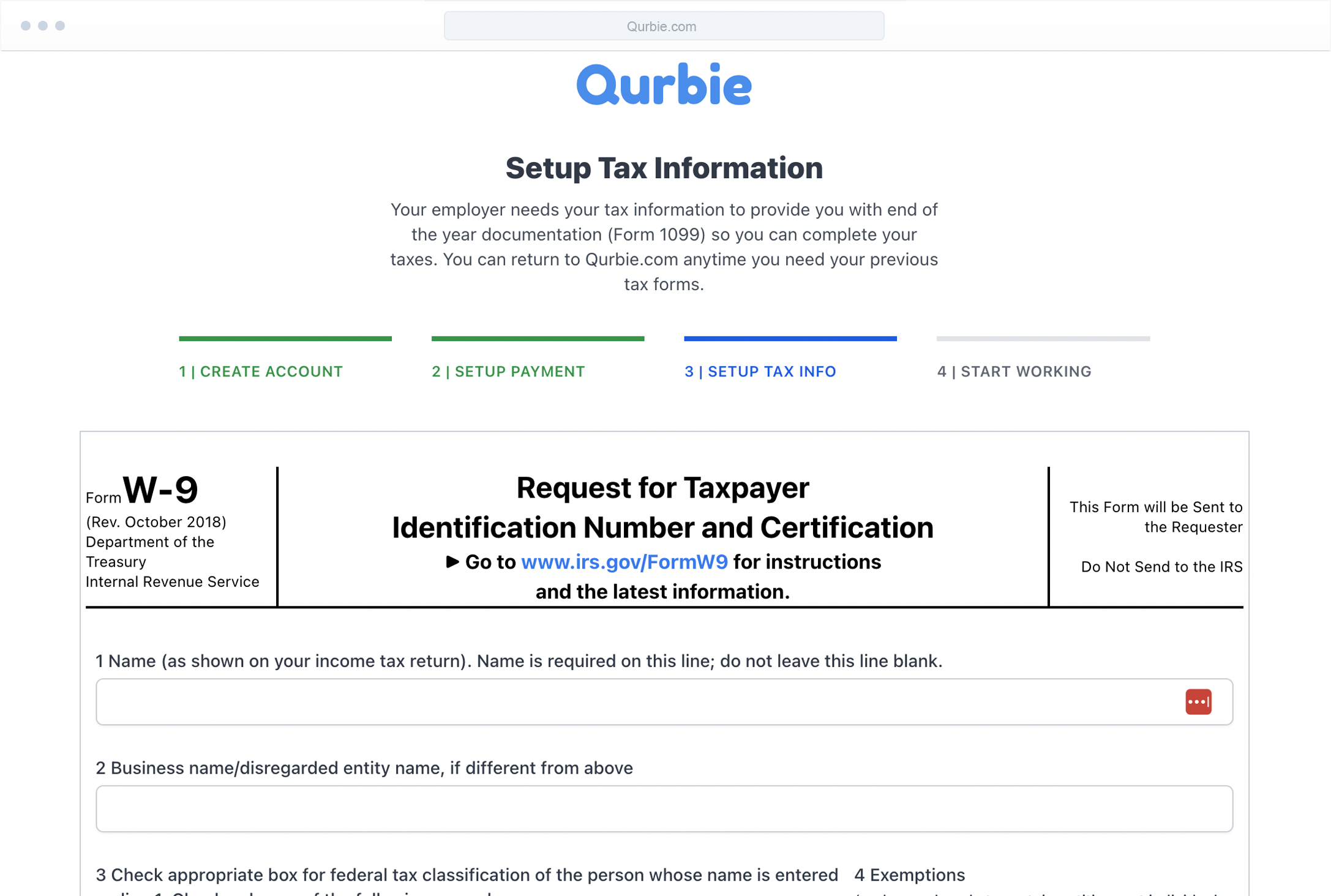

Invite Your Contractors with an Email. Qurbie Does the Rest.

Qurbie will do the work of collecting tax info, contract signing, and setting up direct deposit.

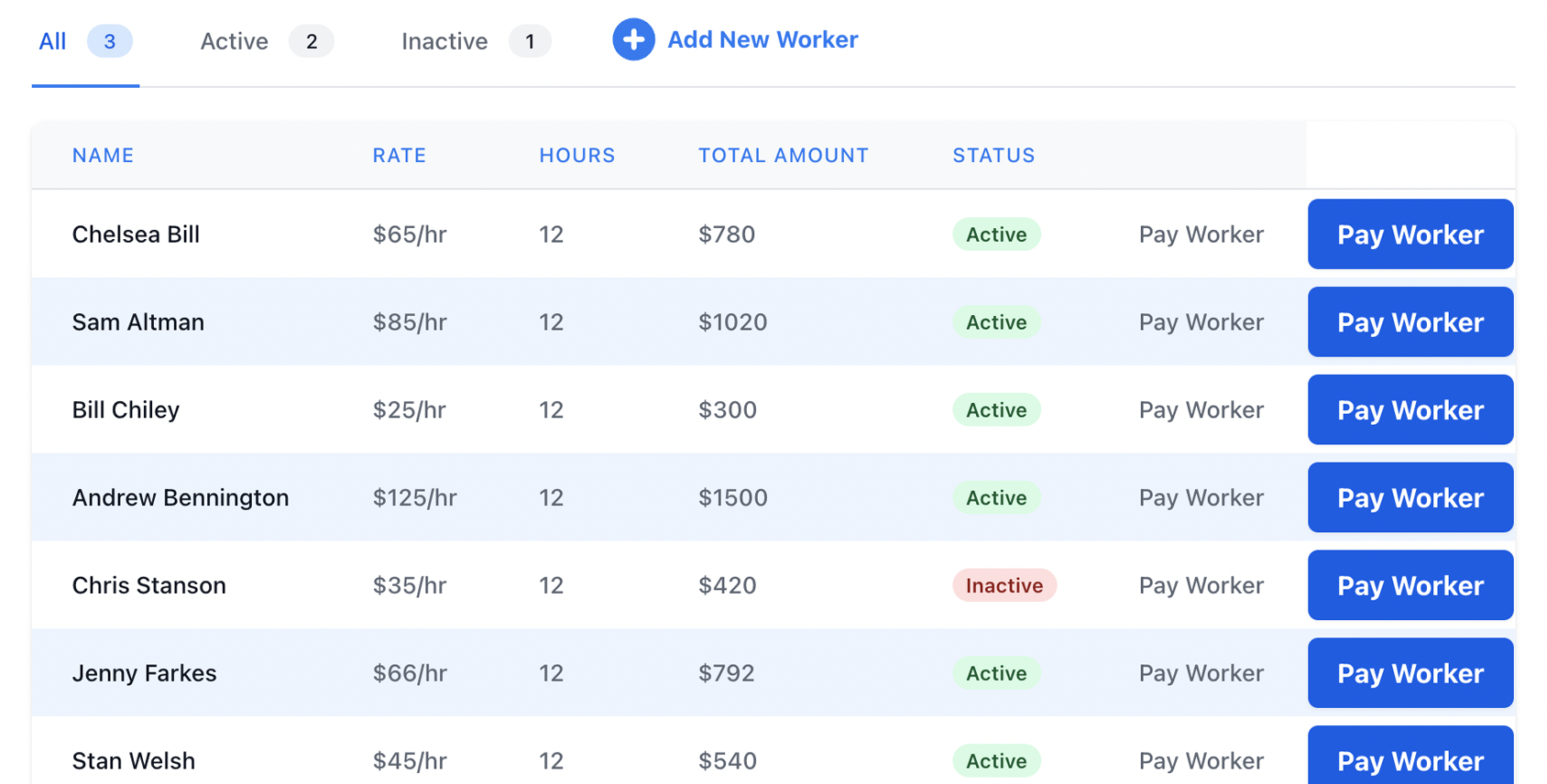

Start Paying Contractors

Qurbie Handles Almost All the Details While Keeping You Up to Date.

Your workers enter hours and request payments. Approve with a click and Qurbie direct deposits the money while tracking everything.

To get started, Qurbie simply needs basic information about your buisiness.

Create an account, verify your identity, and setup your company profile in just a few moments.

Invite Your Contractors with an Email. Qurbie Does the Rest.

Qurbie will do the work of collecting tax info, contract signing, and setting up direct deposit.

Qurbie Handles Almost All the Details While Keeping You Up to Date.

Your workers enter hours and request payments. Approve with a click and Qurbie direct deposits the money while tracking everything.

Get Started Today

Qurbie helps you automatically manage your contractor payments, taxes, and on-boarding without a monthly subscription.

Create Your Account NowQurbie is ❤️ By Businesses... Just Like Yours

Something incredible happens when software solves problems and makes your life better.

This is the magic of what Qurbie does for you and your business.

Qurbie simplified my life when bringing new subs into my company. I used to spend hours tracking everything and now I just click pay.

David NelsonDirector, FoundersForge

It used to take days to get contracts signed and making sure we have the correct tax forms in place. Qurbie finally made this simple.

Brooklyn WellmanCFO Duffek Mobile

Filing my 1099s in Janruary was always a hassle. For awhile I refused to subcontract work out but now I use Qurbie to track everything so I just press button to e-file every year.

Pete ChandlerFreelance Designer

Qurbie Keeps Pricing Simple

We all pay enough in monthly subscriptions.

Simple pricing means only paying for what you use and when you need it.

Per Tax Filing

Contractor 1099-NEC eFiling with the IRS

$4.99

- All Payments Tracked

- Update Payment Amounts

- eFile with IRS Easily

- Records Stored for 7 Years

- Digital Delivery to Recipients

Pay Contractors When Needed. Otherwise Pay Nothing.

$5 per Payment

- On-board Contractors Properly

- Store and Digitally Sign Contracts

- Track Payments Automatically

- Direct Deposit Payments

- Real-time Tracking

- Export Payment History

- Contractor Portal

Enterprise Support

For Large Agencies and Companies

High Volume

- High Volume Payment Discounts

- White Labeling

- Sync with Payroll

- Dedicated Support

- Custom Reports

Frequently Asked Questions

Here are some of the most common questions about Qurbie.

Still have questions? Contact Us.

Is there a monthly fee?

No! We only charge when you make a payment or file your taxes. After talking to countless customers, we found that we could all use a few less subscriptions in our lives! Each payment to a contractor occurs a small fee. Part of the processing fees are built into this and the rest goes to keeping Qurbie in top shape so it can make your life easy for many years in the future! When filing taxes, we charge for up to 3 filings. Then a small fee for each additional filing. This allows us to meet all IRS regulations and keep the platform running smoothly for every tax deadline.

Does Qurbie Offer Full Payroll Services?

We are currently focused on simplifying the process of paying 1099 contractors. We have many future plans and will announce any new features, improvements, or other offerings to existing customers first. Then we'll offer them to the general public. You can also join our newsletter and follow our blog to always be the first to know what is happening at Qurbie!

Is My Data and Information Safe?

Qurbie uses industry best practices and leading security technologies to protect information. We also secure all of your employees information as well. Throughout the platform, we hide all sensitive information and only show it if requested by those with the correct permissions to see the sensitive data. All transactions and access to information is also logged so you know what data was accessed, when, and by whom.

What Do I Need to Get Started?

Getting started is easy! We just need the business owner's information, the business address, Tax ID, and other standard information. We also need you to connect a payment account so we can pay your workers on-time. After sign up is complete, you simply add workers and we'll do the rest! Every time a worker requests payment, we'll ask for approval. Once given, your workers are paid in ~1-3 business days. Payment information is tracked and when Jan. 31st comes around, you just have to verify the information before eFiling! Ready to Get Started? Join Qurbie.

How Long Can I Access My Data and Tax Forms?

Businesses can access their data anytime through their dashboard as long as they don't delete their account. Even if you choose to move to a new platform, you can always return to download your 1099 forms and payment history data. For your employees, we hold their data for at least 7 years. This may fulfill your businesses filing requirements. However, we always allow you to export and print hard copies of all your forms. After 7 years, we may purge older data for security purposes. Of course, we are compliant with all GDPR and similar policies. If you would like your data to be removed from our platform, we will do so according to our policy. For employee data, your employer may need to request the deletion and it may be up to their discretion because of employee retention laws in their state. Contact us and we will work with all parties involved to solve any issues you may have.